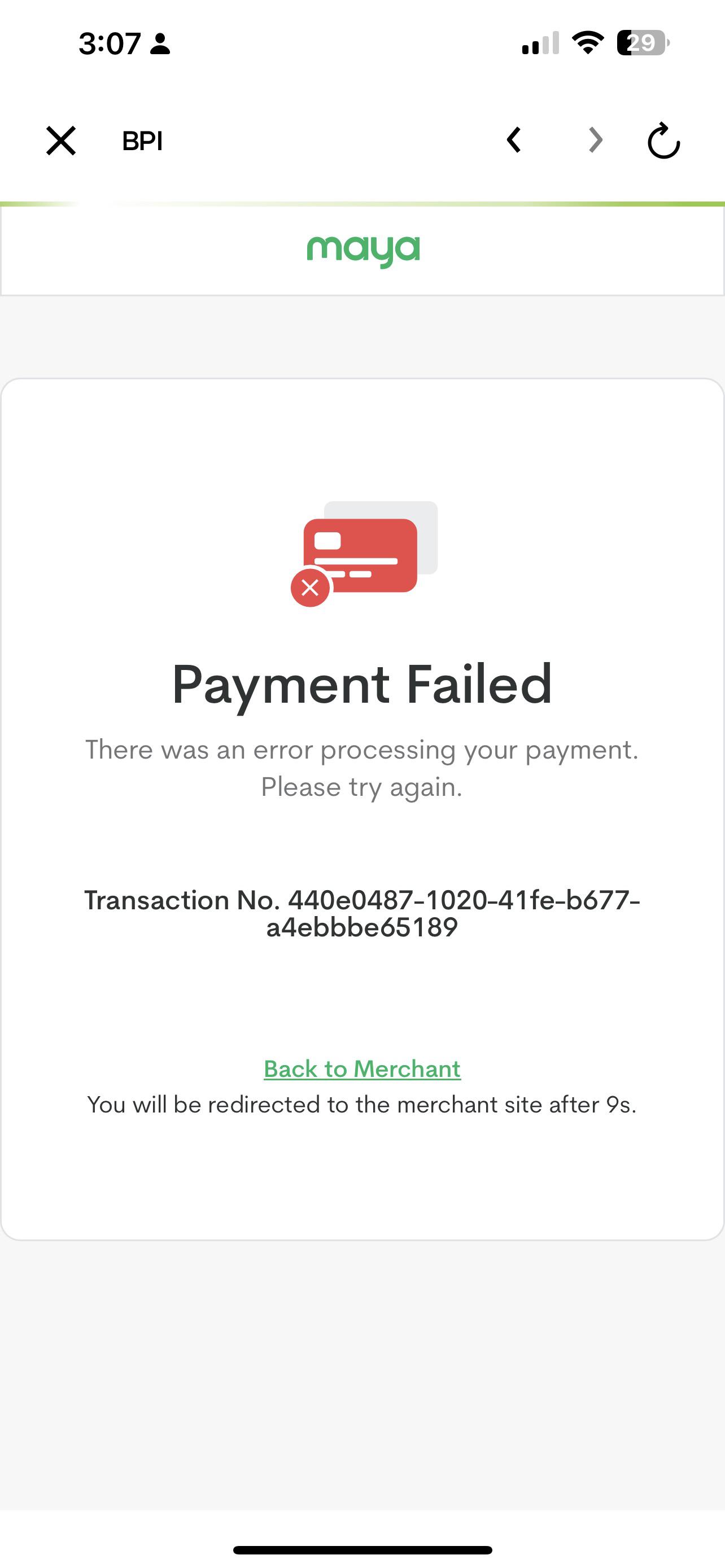

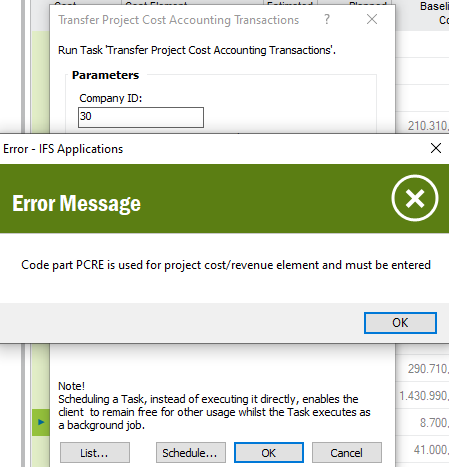

Reviewing Finance Code for Error-Free Transactions

Understanding the Importance of Error-Free Financial Transactions

In today’s digital age, financial transactions are becoming increasingly complex, with multiple parties involved and various systems integrated. As a result, ensuring error-free transactions is crucial to prevent financial losses, maintain customer trust, and comply with regulatory requirements. In this article, we will explore the significance of reviewing finance code for error-free transactions and provide a comprehensive guide on how to achieve this goal.

Common Errors in Financial Transactions

Before diving into the review process, it’s essential to understand the types of errors that can occur in financial transactions. Some common errors include:

- Calculation errors: Incorrect calculations can lead to incorrect payment amounts, interest rates, or fees.

- Data entry errors: Incorrect or missing data can result in failed transactions, incorrect account updates, or security breaches.

- Compliance errors: Failure to comply with regulatory requirements can lead to fines, penalties, and reputational damage.

- Security errors: Vulnerabilities in the code can allow hackers to access sensitive data, leading to identity theft, fraud, or other malicious activities.

Benefits of Reviewing Finance Code

Reviewing finance code is a critical step in ensuring error-free transactions. Some benefits of this process include:

- Improved accuracy: Reviewing code helps identify and fix calculation errors, ensuring that transactions are processed correctly.

- Enhanced security: Code reviews help detect security vulnerabilities, reducing the risk of data breaches and cyber attacks.

- Regulatory compliance: Reviewing code ensures that financial transactions comply with regulatory requirements, reducing the risk of fines and penalties.

- Cost savings: Identifying and fixing errors early on can save financial institutions significant costs associated with correcting errors, resolving disputes, and paying fines.

Steps to Review Finance Code for Error-Free Transactions

Here’s a step-by-step guide to reviewing finance code for error-free transactions:

Step 1: Gather Requirements

Before starting the review process, gather all relevant requirements, including:

- Business requirements: Understand the business logic and rules that govern financial transactions.

- Regulatory requirements: Familiarize yourself with relevant regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Technical requirements: Review technical specifications, including data formats, API integrations, and system architecture.

Step 2: Review Code Structure and Organization

Review the code structure and organization to ensure that it is:

- Modular: Code should be modular, with each module responsible for a specific function or task.

- Reusable: Code should be reusable, with minimal duplication and clear separation of concerns.

- Well-documented: Code should be well-documented, with clear comments and explanations.

Step 3: Check for Calculation Errors

Review calculations to ensure that they are accurate and correct. Check for:

- Rounding errors: Ensure that calculations are rounded correctly to avoid errors.

- Data type errors: Verify that data types are correct to prevent errors due to incorrect type casting.

- Formula errors: Review formulas to ensure that they are correct and up-to-date.

Step 4: Verify Data Entry and Validation

Verify that data entry and validation are correct and robust. Check for:

- Data format errors: Ensure that data is entered in the correct format to prevent errors.

- Data range errors: Verify that data falls within the expected range to prevent errors.

- Data validation errors: Review data validation rules to ensure that they are correct and up-to-date.

Step 5: Review Security and Compliance

Review code to ensure that it meets security and compliance requirements. Check for:

- Security vulnerabilities: Identify potential security vulnerabilities and fix them.

- Compliance requirements: Verify that code meets regulatory requirements, such as AML and KYC regulations.

Step 6: Test and Validate

Test and validate the code to ensure that it works as expected. Use:

- Unit testing: Test individual units of code to ensure that they work correctly.

- Integration testing: Test code integrations to ensure that they work correctly.

- Regression testing: Test code to ensure that changes have not introduced new errors.

💡 Note: Reviewing finance code is an ongoing process that requires continuous monitoring and testing to ensure error-free transactions.

Best Practices for Reviewing Finance Code

Here are some best practices for reviewing finance code:

- Use a code review checklist: Create a checklist to ensure that all aspects of the code are reviewed.

- Use automated testing tools: Use automated testing tools to identify errors and vulnerabilities.

- Collaborate with others: Collaborate with other developers, QA engineers, and business stakeholders to ensure that code meets requirements.

- Document changes: Document changes to the code to ensure that knowledge is shared and errors are tracked.

Conclusion

Reviewing finance code is a critical step in ensuring error-free transactions. By following the steps outlined in this article, financial institutions can improve accuracy, enhance security, and comply with regulatory requirements. Remember to use best practices, such as code review checklists, automated testing tools, collaboration, and documentation, to ensure that code is reviewed thoroughly and efficiently.

What is the importance of reviewing finance code?

+

Reviewing finance code is crucial to prevent financial losses, maintain customer trust, and comply with regulatory requirements.

What are common errors in financial transactions?

+

Common errors in financial transactions include calculation errors, data entry errors, compliance errors, and security errors.

How can I ensure error-free transactions?

+

To ensure error-free transactions, review finance code regularly, use automated testing tools, collaborate with others, and document changes.