Section 8 Counts Food Stamps as Income

Understanding the Impact of Section 8 on Food Stamp Eligibility

When individuals or families apply for food stamps, their eligibility is determined by several factors, including their income level, household size, and expenses. One aspect that can affect this eligibility is the receipt of Section 8 housing assistance. Section 8, also known as the Housing Choice Voucher Program, is a federal program that helps low-income families pay for housing. However, the way Section 8 benefits are counted can vary, and it’s essential to understand how they impact food stamp eligibility.In general, food stamp programs, now more commonly referred to as the Supplemental Nutrition Assistance Program (SNAP), consider various sources of income when determining eligibility. This includes earned income from jobs, unearned income such as Social Security benefits, and other forms of financial assistance. The question of whether Section 8 housing assistance counts as income for SNAP purposes is critical for many applicants.

How Section 8 Impacts SNAP Eligibility

Section 8 housing assistance is not typically counted as income for SNAP purposes. According to the SNAP guidelines, income from certain sources, including most forms of government housing assistance, is excluded from the calculation of gross income. This means that the monetary value of the housing assistance provided through Section 8 is not considered when determining an individual’s or family’s eligibility for food stamps.However, it's crucial to note that while the Section 8 benefit itself is not counted as income, any other form of income or financial assistance that an individual or family might receive could be considered. For example, if a family receives a subsidy for utilities as part of their Section 8 agreement, this might not be directly counted as income, but other income sources, such as wages or investments, would still be included in the eligibility calculation.

Eligibility Determination Process

The process of determining eligibility for SNAP involves several steps and considerations. Applicants must provide detailed information about their household composition, income sources, expenses, and assets. The SNAP office then applies the program’s rules to this information to decide whether the applicant qualifies for benefits and, if so, the amount of the benefit.The key factors in this determination include:

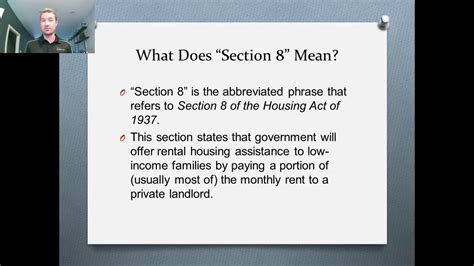

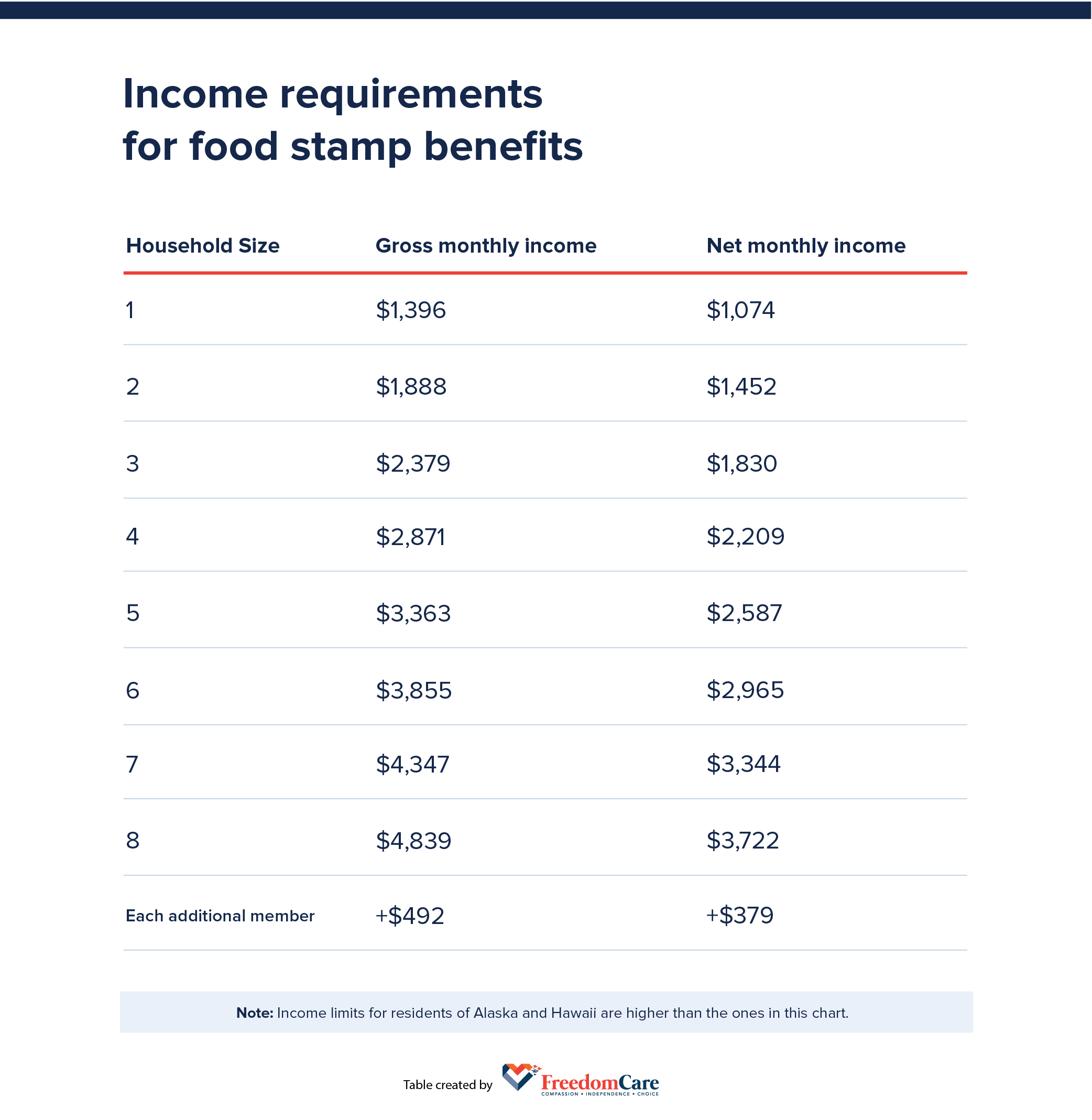

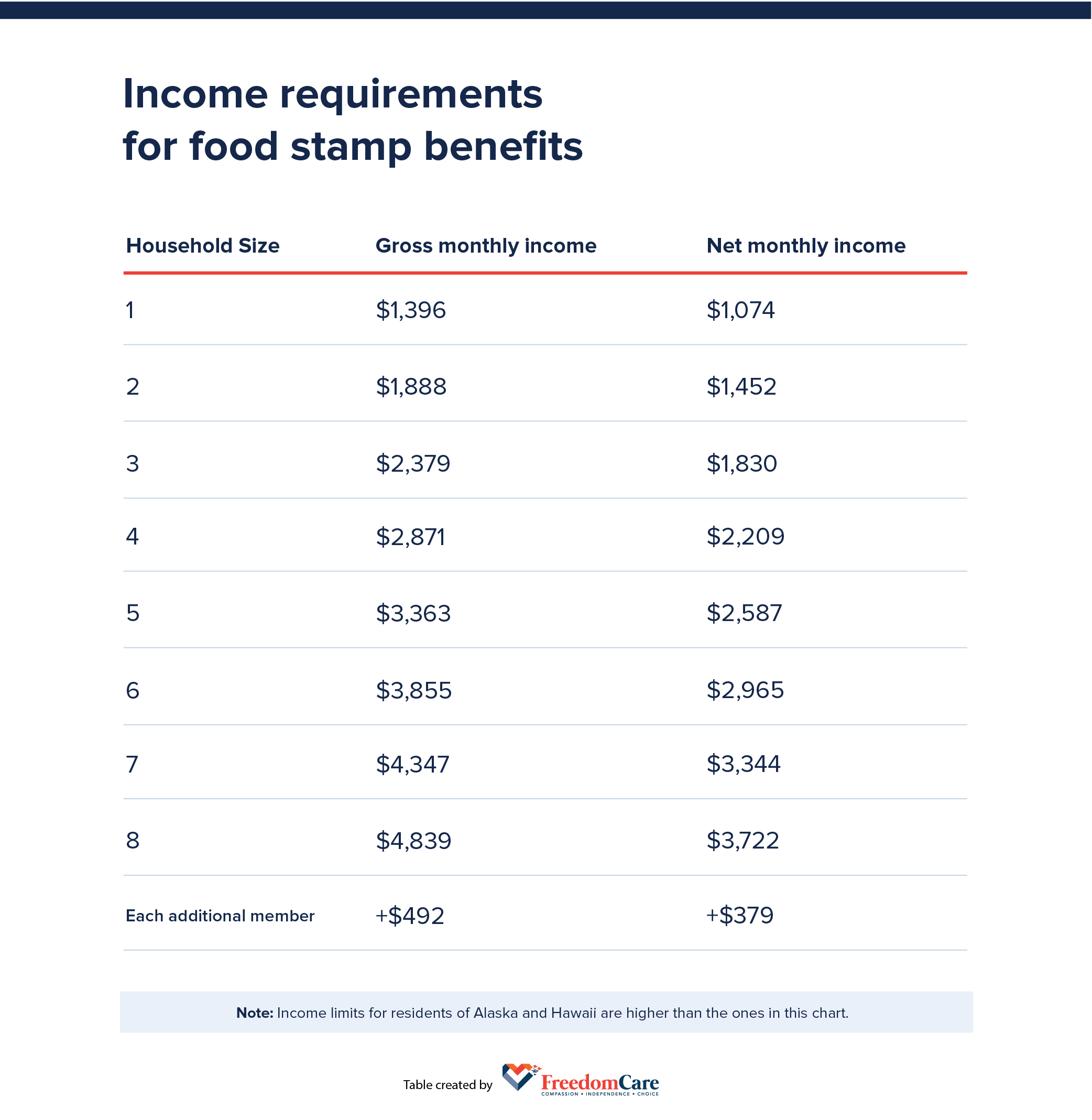

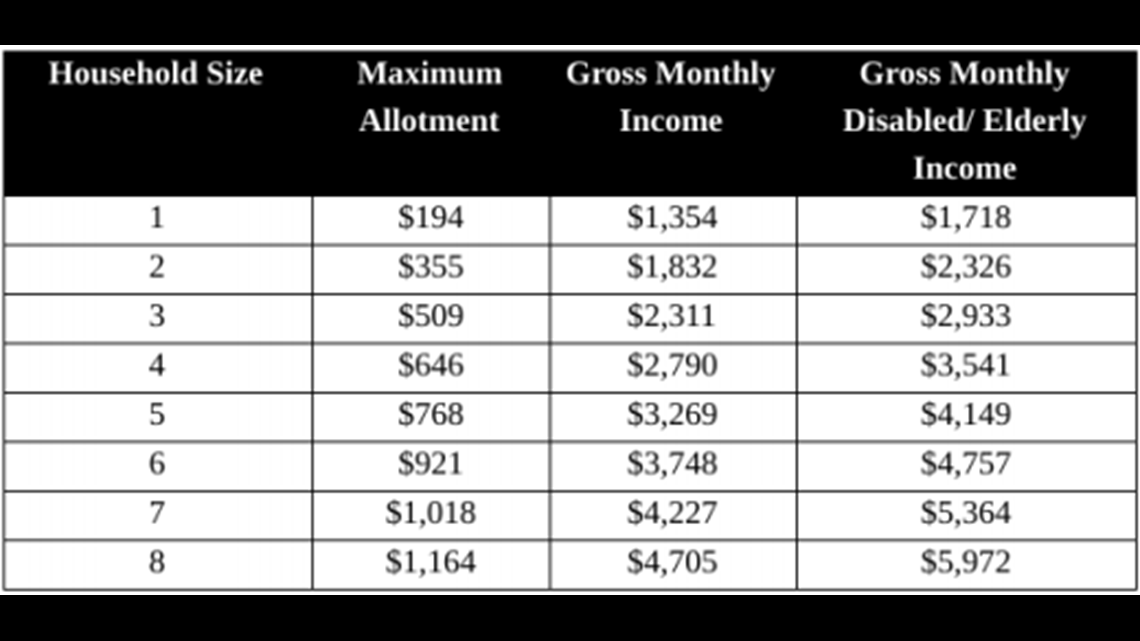

- Gross Income: This is the total income from all sources before any deductions. As mentioned, Section 8 housing assistance is generally not included in this calculation.

- Net Income: After applying certain deductions to the gross income, the net income is calculated. This figure is crucial in determining SNAP eligibility and benefit levels.

- Household Size: The number of people in the household affects the income limits used to determine eligibility.

- Expenses and Deductions: Certain expenses, such as rent (though Section 8 itself is not considered income, the portion of rent paid by the household might be deductible), utilities, and childcare costs, can be deducted from the gross income to calculate the net income.

Importance of Accurate Information

Given the complexity of the eligibility determination process, it's vital that applicants provide accurate and complete information. Failure to report all income sources or to incorrectly report expenses can lead to inaccurate eligibility determinations, potentially resulting in benefits being denied or delayed.📝 Note: Applicants should carefully review the information they provide and ensure they understand what is considered income and what deductions are allowed under SNAP guidelines.

Conclusion and Further Assistance

In summary, Section 8 housing assistance is not counted as income for the purposes of determining eligibility for food stamps. However, understanding the broader context of how income and expenses are considered is essential for navigating the application process successfully. For individuals and families seeking to apply for SNAP benefits, consulting with a local SNAP office or a social services professional can provide valuable guidance and help ensure that applications are processed accurately and efficiently.

How do I apply for SNAP benefits?

+To apply for SNAP benefits, you can visit your local SNAP office, call the national SNAP hotline, or apply online through your state’s SNAP website. The application process typically involves submitting an application form and providing documentation of your income, expenses, and household size.

What are the income limits for SNAP eligibility?

+The income limits for SNAP eligibility vary based on the size of your household. Generally, your gross income must be at or below 130% of the federal poverty level, though net income limits are typically set at 100% of the poverty level after deductions.

Can I receive SNAP benefits if I am already receiving Section 8 assistance?

+Yes, receiving Section 8 housing assistance does not automatically disqualify you from receiving SNAP benefits. Your eligibility for SNAP will be determined based on your household’s income, expenses, and size, with the value of the Section 8 benefit not being counted as income.